In the past two years, the wafer manufacturing market has grown strongly due to the strong demand for advanced processors in the network and data center computers, 5G smartphones, and other high-growth applications such as robotics, autopilot, AI, and other high-growth applications.

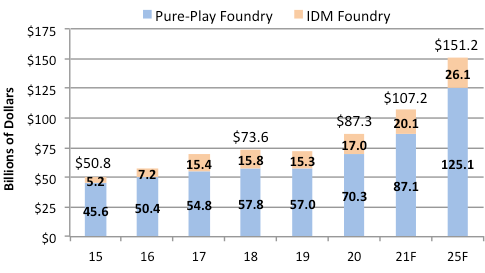

The IC Insights report predicts that total sales in the wafer manufacturing market in 2021 will exceed the US $100 billion mark for the first time, reaching the US $107.2 billion, an increase of 23%, and will continue to grow at an average annual rate of 11.6%, and total sales are expected to reach the US $151.2 billion by 2025.

Growth of global wafer manufacturing market (IC Insights)

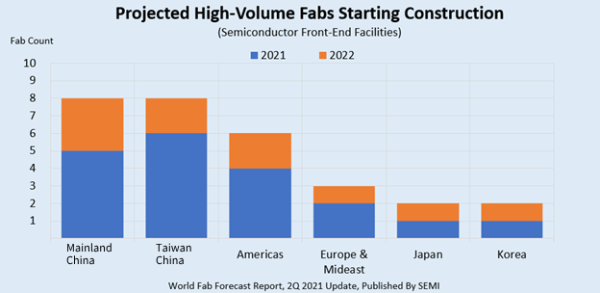

This trend reflects the driving force of emerging application markets, and this year’s global wave of core shortages has further stimulated the capacity expansion of major fabs. According to SEMI, global semiconductor manufacturers will build 29 new factories in 2021 and 2022, of which 19 will be built by the end of 2021 and 10 more in 2022 to meet the growing demand for chips.

Construction of new wafer plant over the world (SEMI)

As shown in the figure, from the perspective of regional distribution, mainland China and Taiwan will take the lead in the construction of new plants, with 8 each, followed by 6 in America, 3 in Europe / Middle East, 2 in Japan, and 2 in South Korea. Of these new plants, the 300mm (12-inch) plant accounts for the majority-15 in 2021 and 7 in 2022. The remaining seven factories include 100mm (4 inches), 150mm (6 inches), and 200mm (8 inches).

When all 29 plants are completed and put into production, they will be able to produce up to 2.6 million wafers (equivalent to 8 inches) per month.

In terms of category, 15 of the 29 factories are wafers with a monthly capacity of 30, 000 to 220000 wafers (equivalent 8 inches), and 4 are storage plants with a monthly capacity of 100000 to 400000 wafers (equivalent 8 inches).

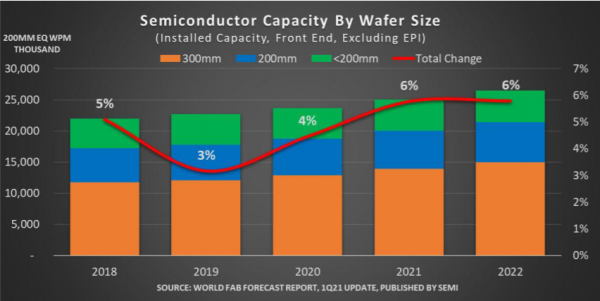

Although the overall production capacity is expanding, the trend of capacity expansion is different for different sizes of wafers. In terms of proportion, 12 inches topped the list, while 8 inches accounted for only 4% in 2020, rising to 6% this year due to lack of a core, which is expected to be maintained in 2022.

Share of global wafer production of different sizes from 2018 to 2022 (SEMI)

In fact, this year’s core deficiencies-analog IC, power management IC, display driver IC, power components MOSFET, MCU, and sensors-are mainly focused on 8 inches of capacity, exposing the lack of capacity. Due to the higher return on investment of the 12-inch wafer production line, the investment in 8-inch production capacity by manufacturing plants has been limited in recent years, and according to the current statistics, this situation will not be fundamentally changed by this round of shortage. According to SIA’s forecast, the global 8-inch wafer production capacity will grow by only 17% from 2020 to 2024.

Unlike the low growth of 8-inch foundry capacity, 12-inch capacity expansion is very active, and the compound annual growth rate is expected to exceed 8% by 2022.

The trend of capacity expansion is accompanied by a rise in capacity utilization. Since 2019, capacity utilization in 8-inch and 12-inch fabs around the world has been rising, exceeding 90% after 2020. The 8-inch, which fell all the way after reaching full load in 2016, fell to about 85% in 2019, and this round rose again, mainly due to the lack of core.

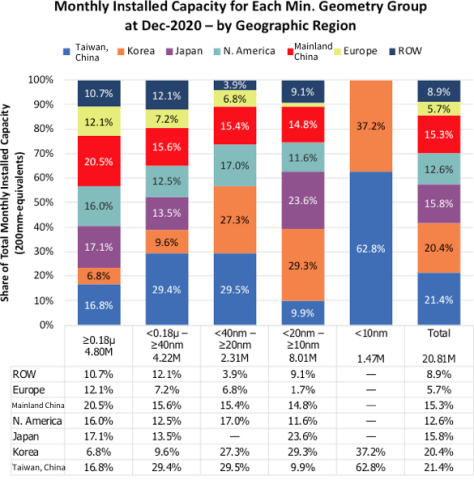

Although all regions of the world are expanding capacity, there are obvious differences in the manufacturing process. Advanced processes below 10nm are concentrated in Taiwan and South Korea, which account for 41.8 percent of global capacity, or nearly half, while the rest is almost covered by China (15.3 percent), Japan (15.8 percent), and North America (12.6 percent).

The regional distribution of these process capacities also reflects the focus and differences of semiconductor products in these regions. Although due to the shortage of chips, chip suppliers have signed contracts with contract manufacturers for many years, the revenue of contract manufacturers increased by 22.6% to $95 billion in 2021 and will continue to grow by 11.9% in 2022, but then global capacity utilization will decline. Gartner predicts that the increase in capital spending will lead to a global oversupply of wafer capacity in 2024 and 2025, and factory capacity utilization will fall below 80 percent. A large part of the capacity expansion comes from the expansion of the fab, which takes at least two years from start-up to mass production.

Regional distribution of global production capacity for different processes (IC Insights)

Fabs account for 35% of all semiconductor capital expenditure in 2021, ranking first. Foundry has accounted for the largest share of semiconductor capital expenditure every year since 2014, with two exceptions: capital spending on DRAM and flash memory surged in 2017 and 2018. With the increasing demand for chips manufactured by advanced technology nodes in the application market, the expenditure of wafer generation factories has become very necessary.

For many companies, this growth in spending will continue until 2022. TSMC‘s capital expenditure, for example, reached $30 billion in 2021, an increase of 74 percent over 2020. The company announced in March 2021 that it plans to invest $100 billion over the next three years and its capital expenditure will reach $35 billion by 2023.

Similarly, in 2021, Samsung spent approximately $30 billion on semiconductor capital. Samsung (https://www.easybom.com/blog/a/samsung-wins-large-tesla-fsd-order-expected-to-ship-in-january-next-year) announced plans to invest 240 trillion won ($210 billion) over the next three years to expand its business. In 2022, Samsung’s capital expenditure will reach $32 billion.

The semiconductor industry is a very market-oriented industry, and its competitiveness is determined by its production capacity, yield, and cost. Post-Moore’s law effect puts forward higher requirements for chip performance, in addition to materials, innovative manufacturing and packaging processes play a decisive role, so it not only brings challenges to semiconductor manufacturing but also brings opportunities to related enterprises.

As semiconductor manufacturing has become the strategic fulcrum of core competitiveness in the increasingly fierce game between China and the United States in the past two years, the actions designed by policymakers of the two governments include targeted incentives to encourage domestic investment in production. to address strategic gaps and reduce global supply chain risks.

Media Contact

Company Name: EASYBOM, INC.

Contact Person: Media Relations

Email: Send Email

Phone: 718-737-2822

City: SEATTLE

State: WA

Country: United States

Website: https://www.easybom.com