Digital Payment Industry Overview

The global digital payment market size was valued at USD 68.61 billion in 2021 and is expected to reach USD 361.30 billion by 2030, expanding at a CAGR of 20.5% over the forecast period.

The worldwide increase in customer preference for real-time payments is one of the major factors driving the market growth. According to statistics provided by McKinsey & Company, India registered 25.6 billion real-time transactions in 2020, witnessing a 70% increase from 2019. The increasing adoption of mobile wallets can be attributed to this significant rise in the use of real-time payments in the country. E-commerce service providers are making efforts to strengthen their competitive positions by moving from traditional credit card and consumer finance solutions toward customer engagement solutions that leverage digital payments.

Gather more insights about the market drivers, restrains and growth of the Global Digital Payment Market

E-commerce companies are also making efforts to deploy their point-of-sale systems to expand their offerings in the digital payment space. For instance, retail giants, such as Shopify and Amazon, are developing point-of-sale systems capable of handling online and in-store transactions. These developments are encouraging banks to improve their digital payment services to preserve their market positions. Government bodies across the world are increasing the limit of contactless payment cards, creating new growth opportunities for market.

For instance, in October 2021, the Treasury and Financial Conduct Authority (FCA) increased the contactless payment limit from USD 50.92 to USD 113.16 in the U.K. This limit was previously increased by FCA from USD 33.95 to USD 50.92 in April 2020 as a COVID-19 measure to reduce contact between payment terminals and shoppers. The growing adoption of 5G network worldwide is also expected to drive market growth. Strong network connectivity enables people to seamlessly make payments and buy products online using mobile devices.

Moreover, enhanced 5G connectivity also helps digital payment service providers implement fraud prevention measures more effectively. According to the GSM Association, 5G network is expected to cover nearly one-third of the world’s population by 2025. Transportation and logistics companies are entering into partnerships with digital payment solution providers to leverage the technology for maintaining social distancing amid the COVID-19 pandemic. For instance, in April 2021, Eurowag, a commercial transport solution provider, invested in Drivitty, a mobile service integrator. Through this partnership, the former company aims to provide vehicle fleet management to its customers.

Digital Payment Market Segmentation

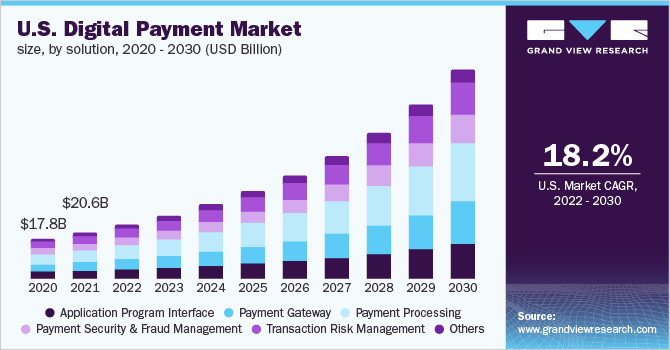

Based on the Solution Insights, the market is segmented into Application Program Interface, Payment Gateway, Payment Processing, Payment Security & Fraud Management, Transaction Risk Management, and Others.

- The payment processing segment dominated the market in 2021 and accounted for more than 25.5% share of the global revenue.

- The payment gateway segment is anticipated to grow at the fastest CAGR over the forecast period. Payment gateway solutions are in demand among merchants as they enable convenient payment.

Based on the Mode of Payment Insights, the market is segmented into Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Point of Sales, and Others.

- The point of sales segment dominated the market in 2021 and accounted for more than 52% share of the global revenue. Point of sale systems are used by retail stores for processing transactions.

- The net banking segment is expected to register a significant growth rate over the forecast period. The benefits offered by net banking, including improved time efficiency, ease of banking, and activity tracking, are among the major factors driving the segment growth.

Based on the Deployment Insights, the market is segmented into Cloud and On-premise.

- The on-premise segment dominated the market in 2021 and accounted for more than 65.0% share of the global revenue.

- The cloud segment is anticipated to grow at the highest CAGR over the forecast period. The continued rollout of smart city projects, coupled with the rising number of unmanned retail stores, is one of the major factors driving the growth of the segment.

Based on the Enterprise Size Insights, the market is segmented into Large Enterprises and Small & Medium Enterprises.

- The large enterprise size segment dominated the market in 2021 and accounted for more than 59.0% share of the global revenue.

- The small & medium enterprises segment is anticipated to grow at the fastest CAGR over the forecast period.

Based on the End-use Insights, the market is segmented into BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, Others.

- The Banking, Financial Services and Insurance (BFSI) segment dominated the market in 2021 and accounted for more than 23.0% share of the global revenue.

- The retail & e-commerce segment is anticipated to register the fastest growth over the forecast period. The growing use of mobile-based payment solutions among customers for retail payments is one of the major factors driving the segment growth.

Based on the Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- North America dominated the global market in 2021 and accounted for the largest revenue share of over 34.0%. The regional market benefits from factors, such as the increasing deployment of and technology enhancements in smart parking meters.

- Banks in Europe are making efforts to launch a European payment initiative aimed at creating a unified payments solution for merchants and consumers across the region.

Market Share Insights

- December 2021: Xiaomi launched the Mi Smart Band 6, which has been built in collaboration with MasterCard and is capable of conducting contactless payments at MasterCard terminals.

- October 2021: PXP Financial Inc., a payment processing service provider, announced its partnership with Shift4, a payment processing solution provider.

- October 2020: Aliant Payments announced that the CryptoBucks cryptocurrency payment mobile app powered by Aliant Payments has added XRP an open-source independent digital asset to its platform. XPR would be available for both Android and iOS mobile apps.

Key Companies Profile:

The competitive landscape of the market is highly fragmented. Market players are focused on strategies, such as partnerships, joint ventures, product innovation, research & development, and geographical expansion to strengthen their market positions. Some of the prominent players in the global digital payment market are:

- Aliant Payments

- Aurus Inc.

- Adyen

- Financial Software & Systems Pvt. Ltd.

- PayPal Holdings Inc.

- Novatti Group Pty Ltd.

- ACI Worldwide, Inc.

- Global Payments Inc.

- Wirecard

- Authorize.net

- Total System Services, Inc.

Order a free sample PDF of the Digital Payment Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/digital-payment-solutions-market