Contact Centers Industry Category Intelligence

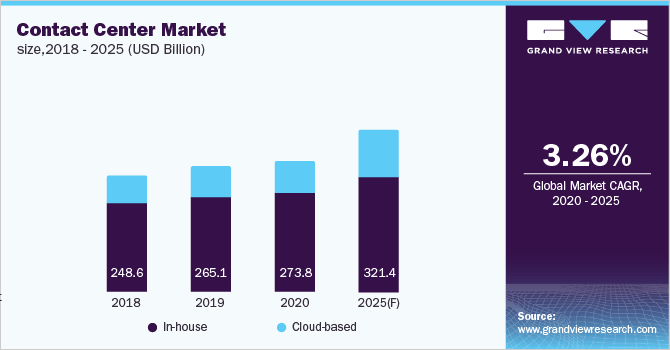

The contact centers market dynamics pre- and post-COVID-19 scenario are drastically different. The pandemic has resulted in companies partnering and acquiring other firms, leading to a higher degree of market consolidation. In addition, contact centers are improving their technological offering to automate and streamline processes.

One of the biggest acquisitions in 2021 is Avaya’s acquisition of contact center developer CTIntegration. CTIntegration has been a technology provider to Avaya. It is the maker of CT Suite and its connectors and has been a part of Avaya’s DevConnect bringing expertise into Avaya OneCloud platform to understand customer behavior and thereby streamline replies and requirements. The acquisition occurred in August 2021, and the financials involved has not been disclosed.

There have been other technological advancements in the market as well. Coca-Cola Europacific Partner, Indonesia has opted to work with Taps 8X8. The objective of this engagement is to provide a secure mobile experience to manage orders through Taps 8X8’s SMS API. The Los Angeles Pacific University has decided to move their entire contact center operations including admission, enrollment, and alumni connect to Dialpad’s cloud system. The system integrator for this project is Dialpad.

Contact Centers Industry Category Intelligence Highlights:

• Migration into a cloud-based environment and technological advancements are the largest trends in the market

• The market features a highly fragmented competitive landscape

• Suppliers widely prefer in-house service provider model to leverage their expertise

• The COVID-19 pandemic has prompted the contact centers to shift from their traditional in-house operation to cloud-based operations.

• The contact centers market supplier intelligence is highly fragmented with a mix of IT service providers and core contact center companies.

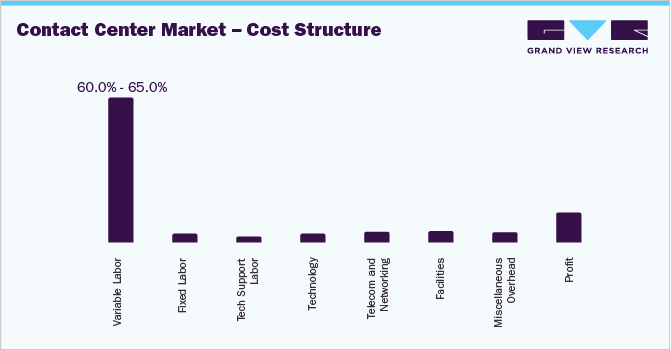

• Labor costs are the largest cost heads for a contact center. Contact centers operate on a value-based pricing scheme. There are also instances of contact centers, which use flat-fee pricing scheme.

• Contact centers follow an in-house service provider engagement model and operate mostly as a basic service provider.

Contact Centers Industry – Pricing and Cost Intelligence Highlights:

Grand View Research has identified the following key cost components for availing Contact Centers:

• Variable Labor

• Fixed Labor

• Tech Support Labor

• Technology Cost

• Telecom and Networking Costs

• Facilities

• Miscellaneous Overheads

• Profits

Variable labor costs are the largest cost component of contact centers and account for 60-65% of the total cost of service.

Grab your copy, or request for a free sample of the “Third-Party Logistics Industry Procurement Intelligence Report, published by Grand View Research” for In-depth details regarding supplier ranking and selection, sourcing, and pricing criteria & startegies

Contact Centers Industry – Supplier Intelligence – Capability based ranking & selection criteria with weightage:

Operational Capabilities – Weightage

- Years in Service 10%

- Employee Strength 25%

- Revenue Generated 20%

- Key Industries Served 25%

- Key Cients 20%

Functional Capabilities – Weightage

Type of deployment 40%

• On-premise

• Cloud-based

Type 40%

• Voice-based

• Text based

• Social media-based

Use of technology 20%

• Chatbots, automated call director

• Caller analytics tools

• Process automation tools

List of Key Suppliers in the Contact Centers Category

• [24]7.ai, Inc.

• Alliance Data Systems, Inc.

• Alorica, Inc.

• Atento

• BT Communications Ltd.

• Concentrix

• Convergys Corp.

• Genpact

• IBM Global Process Services Pvt. Ltd.

• Tata Consultancy Services Ltd.

• Wipro

Add-on Services provided by Grand View Research Pipeline:

Should Cost Analysis

In the contact centers category intelligence study, we have estimated and forecasted pricing for the key cost components while availing services from contact centers. Salaries of variable labor are the largest cost component of contact center services. It accounted for more than 60% share in overall contact center service cost. The cost of facilities also plays an important role in the should-cost analysis of contact center services. The cost of facilities has shown erratic trends. While the rental rates have been on a constant rise in the pre-Covid-19 era, the pandemic has resulted in employees working from home or remote locations and forced companies to upgrade their IT infrastructure to facilitate this change. Since most of these IT investments are of a CAPEX nature, these changes are expected to be sustainable. Hence, there is uncertainty about offices having 100% occupancy post the pandemic as well. With several contact centers not renewing contracts and limiting their physical real estate space, rental rates have dropped significantly. While chances of employees resuming offices physically post the pandemic are moderate to high, it is highly unlikely that rental rates will increase at the rate it used to before the pandemic.

Rate Benchmarking

Software development is one of the most important aspects while analyzing the rate benchmarking of contact center services. In our research, we have analyzed the hourly rates of contact center software development per region by using the rate benchmarking method. We found that the average contact center software development cost in the APAC region is 70%-80%% lower than the cost of North America and Western Europe. Moreover, the cost of CSR and supervisors are 20%-30% lower in APAC compare to the rest of the world.To gain a comprehensive understanding of the other aspects of rate benchmarking, please subscribe to our services for the complete report.

Salary Benchmarking

Labor is one of the key cost components incurred while offering a product or service. Understanding the pricing structure of salary is important for organizations in selecting the appropriate supplier and building a good negotiation strategy. It is also an important factor in determining whether the category under focus should be outsourced or built in-house.

Our research indicates that Concentrix software engineers earn 40% lower salaries than software engineers of other key industry players like Avaya and Exotel. However, Concentrix gives 50% higher bonuses to its software engineers compare to its peers.

Supplier Newsletter

It is cumbersome for any organization to continuously track the latest developments in their supplier landscape. Our newsletter service helps them remain updated, to avoid any supply chain disruption which they may face, and keep a track of the latest innovations from the suppliers. Outsourcing such activities help clients focus on their core offerings.

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Browse through Grand View Research’s collection of procurement intelligence studies:

- Engineering, Procurement, and Construction Market – North America is the largest regional EPC market globally and is valued at USD 2,027.3 billion in 2020. It is expected to grow at a modest CAGR of 1.8% from 2020 to 2025. One of the major reasons for this slow growth is the COVID pandemic.

- Electric Vehicle Charging Connecter Market – EV charging connector suppliers are collaborating with regional players to benefit from their knowledge of the local market, and maintain high profit margins, low overhead costs, and their overall competitiveness in the market.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: www.grandviewresearch.com/pipeline/contact-center-market-procurement-intelligence-report