The global electric vehicle market size was valued at USD 388.1 billion in 2023 and is expected to reach USD 951.9 billion by 2030 at a CAGR of 13.7% during the forecast period 2023-2030. With advancements in technology, increasing environmental consciousness, and supportive government policies, EVs have gained significant traction as a viable and sustainable transportation option. As concerns over climate change and air pollution intensify, consumers and industries are increasingly turning to electric vehicles to reduce their carbon footprint and contribute to a greener future. This growing global momentum has propelled the EV market into a transformative phase, with innovations and investments driving the expansion of EV adoption across the world.

Commercial vehicles to be the fastest growing market by volume during forecast period

The commercial vehicle segment includes LCVs and HCVs. HCVs combine two categories of vehicles − heavy trucks and buses & coaches. The nature of these vehicles limits their production volumes and growth rates as they are used in specific applications such as logistics, construction, and mining industries. On the other hand, LCVs have come a long way from having bare-essential features to full-blown utility vehicles that can be used for passengers as well as commercial purposes. The majority of used LCVs and HCV’s include vans, mini-buses, pickups, trucks etc. Various companies such as Volvo Group, Daimler AG, Traton Group, BYD, Nikola Motor, Tesla, DAF Trucks, etc. already have EV models available or are currently under development. For instance, in May 2022, Stellantis and Toyota Motor partnered to develop a new large-size commercial van, including a battery electric version. This collaboration completes a full lineup of light commercial vehicles (LCV), consisting of compact, mid-size, and now a large-size LCV. Similarly, ZF’s Commercial Vehicle Solutions (CVS) department unveiled ‘AxTrax 2’ and ‘AxTrax 2 dual’ electric central drive system designed for various types of vehicles, ranging from light delivery vans to heavy-duty trucks and trailers. Increasing sales of electric buses, particularly in China, has contributed to the growth of the electric bus segment. In the near future, several countries are expected to replace their existing fuel-based bus fleets with electric buses. The increasing trend of the replacement of fossil fuel-based public transport fleets with electric buses is expected to drive the growth of electric commercial vehicle market during the forecast period. Additionally, the growth of e-commerce, logistics, and shared mobility are expected to drive the growth of electric commercial vehicles during the forecast period. Electric vans are expected to witness significant growth in Europe and Asia owing to their extensive use in businesses. In the coming years, EV LCVs are expected to be the fastest-growing market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=209371461

FWD to be the largest market during the forecast period

A front wheel drive vehicle has the transmission system attached to its front axle and wheels. It is significantly cheaper to design and produce compared to other wheel drives. The vehicle is therefore cheaper for consumers. Most front wheel drives provide better mileage compared to rear wheel drives as the weight of the drivetrain is lower than that of the rear wheel drive. They also provide better traction as the weight of the engine and transmission are over the front wheels. This makes the vehicle easier to operate in difficult weather conditions such as snow and heavy rain. However, the handling of these vehicles is harder compared to other drives, especially at faster speeds. In 2022, there were total sales of 1.8 million FWD EV cars in Asia Pacific followed by 0.3 million in Europe and 0.04 Million in North America. BYD Song Pro/Plus was the second best-selling passenger car worldwide which has a FWD type. Some popular FWD EVs include BYD Qin Plus, BYD Han, Tesla Model Y, BYD Donphin, Tesla Model 3, BYD Yuan Plus EV, BYD Tang, Tesla Model Y, Tesla Model 3, GAC Aion Y, GAC Aion S, Changan Benni EV, Chery QQ Ice Cream, Hozon Neta V EV, Chery EQ 1 etc. These vehicles are better suited for places with high traffic, metro cities, etc. Most mini EVs including GW Black Cat, GW White Cat and GW Good Cat are sold under FWD specification. These 3 cars sold well in the past few years. FWD EVs were relatively high in use in the past due to manufacturers simply converting their existing ICE vehicle structure to EV by replacing parts during production. This worked well in the initial shift to EVs when manufacturers were not sure about plans to develop EVs fully.

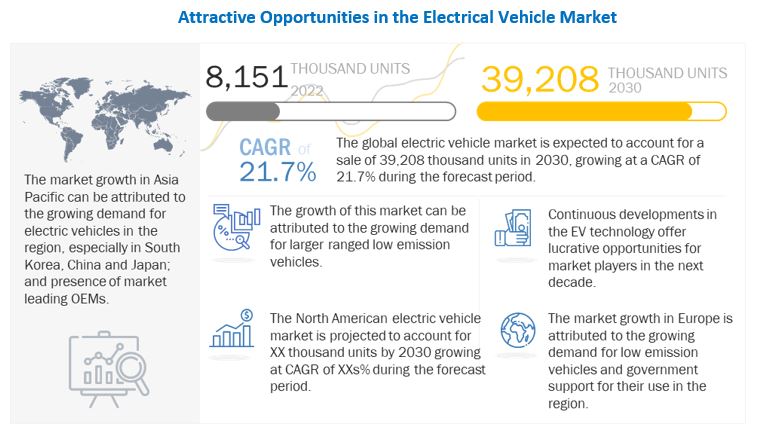

Asia Pacific to be the largest and the fastest growing market by value during the forecast period

The region is home to some of the fastest-developing economies, such as China and India. The governments of these emerging economies have recognized the growth potential of the EV Market trends and, hence, have taken different initiatives to attract major OEMs to manufacture electric vehicles in domestic markets. The region is home to 93 of the world’s most polluted cities, and has a high energy demand. As of 2022, transportation sector in the region accounts for around 14% of overall emissions. Thus, countries in the region, are planning to reduce emissions in the coming years. China, the e-mobility leader in the region, had set a target of over 20% EV sales by 2025, which it had already achieved in 2022 and is expected to have around 35% in 2023. Similarly, countries such as South Korea, Japan and India have also announced plans to shift to EVs in coming years. India for instance, plans to have 30% of its passenger car sales to be electric by 2030. South Korea and Japan are also aiming to be among the world’s top 5 EV producers by 2030. China is also investing significantly in the production of both electric passenger as well as commercial vehicles, with plans for export.

Key Market Players

The electric vehicle market is dominated by BYD (China), Tesla (US), Volkswagen AG (Germany), SAIC Motors (China), and Stellantis (Netherlands), among others. These companies have worked with other players in the EV ecosystem and developed best in class EV technology.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=209371461

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-market-209371461.html