Managing finances can be overwhelming, but Kamunity is committed to making that process easier and less isolated. The platform provides a single pane of glass for their users to manage all of their accounts, presents insights that aren’t available on any other personal finance platform today, and what’s better than all this being available for FREE, with no subscription fee whatsoever!

Kamunity is truly about the users and is dedicated to help them make the most of their finances, without having to pay for it or get cluttered by advertisements.

Learning From The “Kamunity”

Kamunity’s mission is to provide a safe space for users to engage, provide feedback, and facilitate open dialogue among users by reviewing merchants. Kamunity empowers them to explore new ways to save and invest money based on real-life experiences within their own community.

Leveraging the aggregated and anonymized information of its users, Kamunity not only simplifies the process of managing finances, but also fosters a sense of camaraderie among its users as they embark on their financial journeys. It connects people from different walks of life who are perhaps at the same stage in their financial journey to seek support from one another, while learning from those who have navigated through these stages.

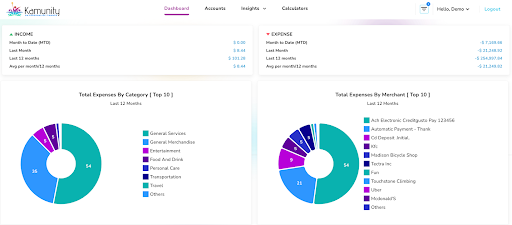

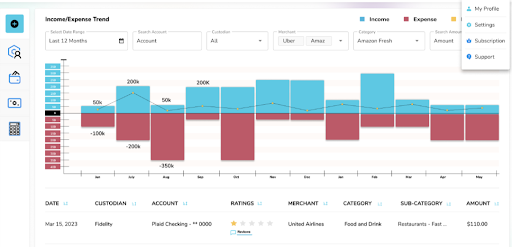

Data-Driven Insights

Kamunity provides valuable insights derived from real user data. By analyzing spending and investment behaviors, users gain clearer understanding of their financial habits. With reliable information at their fingertips including tracking monthly expenses, monitoring investment performance, and identifying areas for improvement, they can confidently make informed choices.

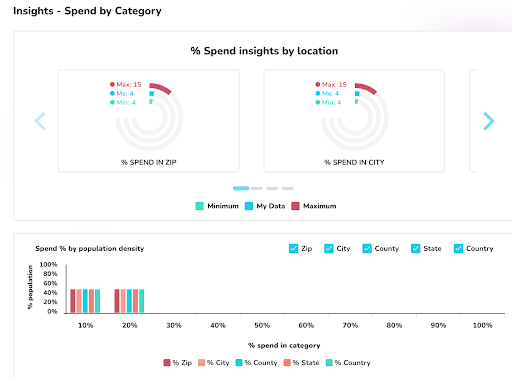

Kamunity offers niche insights to help the users view where they stand with their expenses compared to others in their neighborhood, through its analytics capability leveraging the aggregated data, so the individual user’s data is never shared, and remains anonymous.

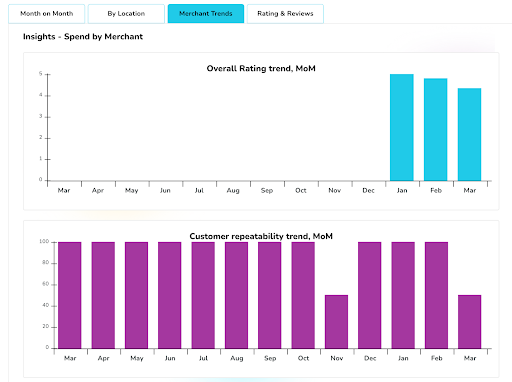

Finding reliable merchants is often a struggle. Traditional rating systems sometimes lack sufficient data, leading to frustration and uncertainty. Kamunity’s founders explained, “More than 50% of consumers look for reviews before buying, yet only 5-10% of the users actually give ratings and write reviews. That’s a problem; 5-10% of the consumers shouldn’t be influencing the decision of majority of consumers. And that is exactly what we have set out to tackle…”

Kamunity revolutionizes this process by incorporating metrics such as customers repeatability, rating trends over time, and business age to provide a comprehensive evaluation. Using this wealth of actionable information, Kamunity users can make better decisions about where to spend their hard-earned money.

Upholding Strict Privacy Standards

A source for Kamunity stated, “Through our one-of-a-kind platform, users can seek financial wisdom without exposing personal information. Our vision is to leverage our social platform so people can use their shared learnings and experiences to regain control of their finances.”

By only collecting and retaining necessary data, Kamunity prioritizes user privacy and confidentiality.

All user data is encrypted during transit and at rest, employing 256-bit SSL encryption and security practices on par with leading banks. Unlike traditional platforms that may store sensitive banking information, Kamunity does not retain users’ bank credentials whatsoever. Instead, these credentials are directly transmitted to the respective financial service from the user’s browser, which means that Kamunity never sees nor stores any users’ bank details.

Enhancing User Experience

Recognizing that no two financial journeys are alike, Kamunity goes above and beyond to customize the insights, uniquely tailored to each user’s spending behaviors, and location. By considering these key factors, Kamunity ensures that users get access to information that is not only relevant, but also aligned with their specific financial goals and aspirations.

In their mission of helping users navigate through the key life milestones, Kamunity has also launched a college cost calculator on their platform, which can help users kick start planning for college education of their children. Kamunity is helping users simplify this overwhelming process, one easy step at a time.

In their commitment to enhancing user experience, Kamunity maintains an ad-free policy, ensuring a clutter-free environment where users can focus on what truly matters: their financial well-being. Kamunity encourages users to maximize productivity and engagement by eliminating distractions and streamlining the user interface.

Conclusion

Kamunity aims to be the one-stop shop for all things related to personal finance. By aggregating user consented data and providing personalized insights, it empowers users to make informed financial decisions. Kamunity sets itself apart as a platform that prioritizes the needs and preferences of its users above all else, by providing customized insights and an ad-free environment.

For further details, please use the information below to contact Kamunity or sign up at https://www.kamunity.io/signup

Media Contact

Company Name: Kamunity

Contact Person: Amit

Email: Send Email

Country: United States

Website: https://www.kamunity.io/