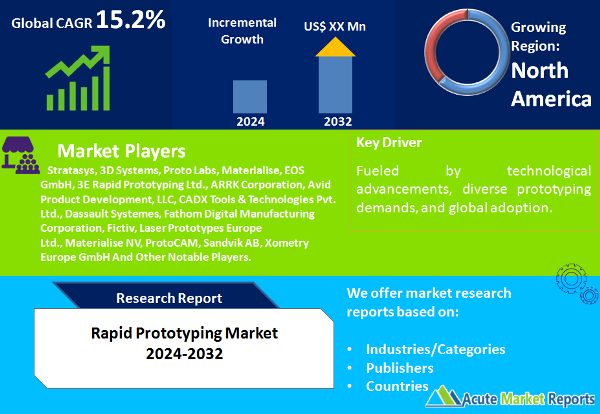

The market for rapid prototyping is anticipated to expand at a CAGR of 15.2% from 2024 to 2032, driven by technological advancements, varied prototyping requirements, and global adoption. Even though cost limitations present a hurdle, it is anticipated that strategic initiatives by key actors and a rise in SME awareness will alleviate this constraint. The segmentation analysis elucidates the prevalence of distinct processes and prototype types during various phases, providing businesses with valuable insights to facilitate the alignment of their strategies. The market’s trajectory highlights the geographical importance of the Asia-Pacific region in propelling future expansion. In an increasingly competitive market, major actors are placing greater emphasis on collaboration and innovation to maintain their market positions amidst a dynamic environment. In general, the rapid prototyping industry offers profitable prospects for participants throughout the value chain, on the condition that they adeptly navigate the dynamic terrain with strategic anticipation and adaptability.

Ongoing technological developments in prototyping technologies drive the rapid prototyping market. Key processes that propel innovation include Fused Deposition Modelling (FDM), Multi Jet Fusion (MJF), Stereolithography (SLA), and Selective Laser Sintering (SLS). These technologies facilitate the expedited fabrication of prototypes characterized by increased complexity and precision. Prominent organisations including 3D Systems and Stratasys have emerged as trailblazers by introducing innovative solutions that address the varied requirements of industries. The extensive adoption of Stratasys’ FDM technology in the aerospace and automotive industries exemplifies the influence of technological progress on market expansion.

The increasing demand for diverse prototyping types is another factor propelling the rapid prototyping market. User experience prototypes, Proof-of-Concept (PoC), functional prototypes, and visual prototypes all serve distinct functions throughout the product development lifecycle. Organisations such as Proto Labs and Materialise provide an extensive selection of prototyping services to meet the changing demands of sectors including consumer products, electronics, and healthcare. In addition to accelerating product development, the adaptability of prototype types contributes to enhanced design iterations, which in turn decreases time-to-market.

Browse for a complete report at: https://www.acutemarketreports.com/report/rapid-prototyping-market

The global market for rapid prototyping is expanding at a rapid rate, with geographically specific trends being particularly notable. Asia-Pacific is characterized by the highest Compound Annual Growth Rate (CAGR), which is primarily attributable to the expansion of manufacturing operations in nations such as China and India. Additionally, established manufacturing sectors in North America and Europe substantially contribute to market expansion. Rapid product customization and validation are a driving force behind the demand for rapid prototyping services in these regions. Organizations such as Proto Labs and 3D Systems have strategically extended their market share in these areas to take advantage of the increasing prevalence of rapid prototyping technologies.

Notwithstanding the favorable trajectory, the market for rapid prototyping is impeded by financial limitations. Small and medium-sized enterprises (SMEs) may encounter significant upfront costs when they adopt advanced prototyping technologies. The extensive implementation of rapid prototyping is hindered by this financial obstacle, specifically among lesser enterprises operating in emerging markets. This reluctance is supported by the observation of delayed adoption rates in areas with a greater concentration of small and medium-sized enterprises (SMEs).

Get Free Sample Copy From: https://www.acutemarketreports.com/request-free-sample/140194

Digital Light Processing (DLP) and Electron Beam Melting (EBM), in addition to Stereolithography (SLA), Selective Laser Sintering (SLS), Fused Deposition Modelling (FDM), and Multi Jet Fusion (MJF), are utilized to segment the market for rapid prototyping. FDM emerged as the process that generated the most revenue in 2023, owing to its extensive implementation across diverse industries. On the other hand, MJF is anticipated to demonstrate the most substantial CAGR from 2024 to 2032. It is expected that the increased efficacy with which MJF can produce complex prototypes will boost its adoption.

User experience prototypes, Proof-of-Concept (PoC) prototypes, functional prototypes, and visual prototypes comprise additional prototype segmentation. Functional prototypes generated the most revenue in 2023, owing to their indispensable function in product validation and testing. Anticipated to yield the highest compound annual growth rate (CAGR) between 2024 and 2032 are user experience prototypes. This transition signifies the increasing recognition of the value of user-centric design and the criticality of developing prototypes that simulate the end-user experience in minute detail.

Geographically, distinct tendencies characterize the rapid prototyping market. Asia-Pacific is anticipated to experience the maximum CAGR during the forecast period, as industrialization and manufacturing activities increase. It is anticipated that North America will continue to hold the highest revenue percentage in 2023, primarily due to the robust adoption of advanced prototyping technologies and a mature manufacturing sector. With revenue marginally lagging that of North America, Europe is positioned for consistent expansion. These developments are consistent with the worldwide transition to digital manufacturing and the prioritization of swift product innovation.

Rapid prototyping is an industry characterized by fierce competition among major participants. Prominent firms such as Stratasys, 3D Systems, Proto Labs, Materialise, EOS GmbH, 3E Rapid Prototyping Ltd., ARRK Corporation, Avid Product Development, LLC, CADX Tools & Technologies Pvt. Ltd., Dassault Systemes, Fathom Digital Manufacturing Corporation, Fictiv, Laser Prototypes Europe Ltd., Materialise NV, ProtoCAM, Sandvik AB, and Xometry Europe GmbH are significantly influencing the competitive environment. These actors implement various strategies, such as ongoing technological innovation in prototyping, strategic partnerships, and international expansion. Revenue-wise, Stratasys was the market leader in 2023, owing to the diverse product portfolio it offered that caters to numerous industries. All major actors are anticipated to concentrate on R&D, partnerships, and acquisitions to preserve their competitive edge between 2024 and 2032. It is expected that the market will progress due to the focus on addressing industry-specific requirements and offering comprehensive prototyping solutions.

Stay Updated with the Latest Market news: https://www.mobilecomputingtoday.co.uk/news/

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com