WigoSwap is a new Defi protocol on the progressive Fantom Blockchain that has recently gained popularity in DeFi communities by introducing a novel concept known as Gamified Burning Mechanism. GBM addresses one of the most significant problems facing DeFi: incentivizing liquidity providers. Based on the underlying idea, WigoSwap aims to utilize gamification to prevent running out of LP rewards despite having a 2 billion hard-cap. By this new mechanism, WigoSwap opens up the possibility of perpetually minting new tokens and incentivizing the users.

What is a Liquidity Provider and What is The Problem?

In general, DeFi greatly relies on liquidity providers. Locking crypto assets into smart contracts lead to the generation of liquidity pools where decentralized financial services such as exchanging, lending, borrowing, etc. take place. As long as liquidity providers are consistently incentivized, the required liquidity would be provided for financial services. However, incentivizing liquidity providers is not as easy as it seems. Transaction fees on DeFi protocols constitute the earnings gained by liquidity providers to a certain extent. Nevertheless, on networks such as Fantom where transaction fees are low, more powerful incentives are required.

To overcome the above-mentioned problem, DeFi platforms introduced a concept known as ‘yield farming’ to increase the incentives for liquidity providers. As liquidity providers lock their assets into a Decentralized Exchange’s smart contract, they receive LP Tokens that represent their share in liquidity pools. The liquidity providers are then able to use their LP Tokens in farms and get rewarded with the protocol’s native token. However, this method also has its challenges. The problem is where a DeFi protocol can mint new tokens and reward its liquidity providers for as long as the maximum supply of the tokens is not reached. In other words, due to the existence of hard-cap which is a significant element within every reliable blockchain project, the possibility of rewarding the users will eventually come to an end at a certain time.

WigoSwap’s Approach to Incentivization Problem

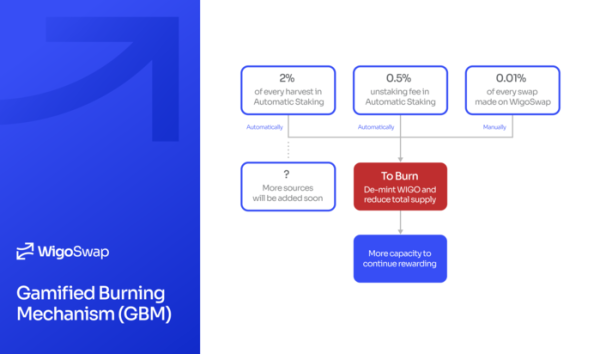

WigoSwap utilizes a particular type of smart contract that makes it possible to genuinely burn tokens and remove them from circulation by reversing the minting process known as de-minting. Note that in most blockchain projects, the process of burning is limited to sending tokens to a dead address, and in effect, the tokens are not deducted from the total supply. However, the de-minting approach utilized by WigoSwap is in essence a true example of the so-called burning process. This allows for minting new tokens in the future while benefitting from the advantages gained through the existence of a hard-cap. This would be a promising feature ever introduced into a DeFi protocol.

WigoSwap’s Goal is to Incentivize Liquidity Providers Consistently

As indicated on WigoSwap’s roadmap, several phases are considered for the full realization of Gamified Burning Mechanism or GBM. In the initial stage, the burning mechanism includes the basic functions of the decentralized exchange system such as un-staking fees, swap fees, and so on. In the following phases, the burning process is accelerated with the help of simple blockchain-based games. WigoSwap has already announced that soon it will offer game developers on the Fantom Network the possibility to use incentive programs and IDOs on WigoSwap to develop their games using GBM. It seems that the trailblazing approach introduced by WigoSwap will act as a long-term and stable method to be implemented within the DeFi industry for years to come.

What Phase is WigoSwap in Currently?

WIGO token has not been released yet. Due to announcements IDO will be held on February 9th on wigoswap.io. Moreover, Wigo Bank and Wigo Farms that allow for staking and farming activities on the platform will be introduced on the same day. Based on the WigoSwap news spreading through the Fantom community and other DeFi-related communities, a favorable reception is expected. Furthermore, an initial campaign is being launched on WigoSwap’s social media to reward liquidity providers through an airdrop before the launch of the farms.

WigoSwap’s Tokenomics

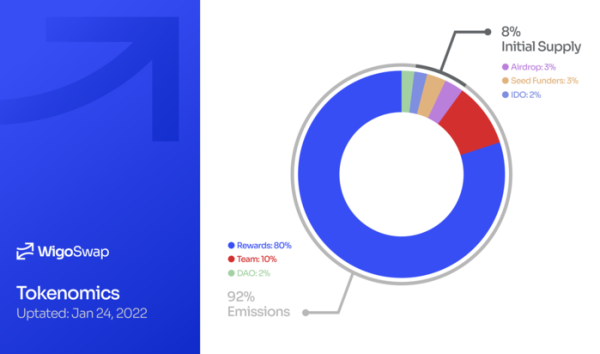

In all, just 8% of the WIGO tokens have already been minted before the launching of farms. 80% of the maximum supply of WIGO tokens will be used for the rewards granted to liquidity providers. The multiplier for reward distribution in the first month is 9, which is a captivating number.

WigoSwap’s tokenomics is as follows:

- Airdrop (3%)

- Seed Funders (3%; distributed over time and based on vesting contract)

- IDO (2%)

- Rewards (80%)

- Team and Marketing (10%; planned to be distributed over time based vesting contract)

- DAO (2%)

As the project’s IDO is due on February 9th, you can find detailed information related to the project on its website or Twitter account.

Media Contact

Company Name: WigoSwap

Contact Person: Aaron Leblac

Email: Send Email

Country: Switzerland

Website: https://wigoswap.io/